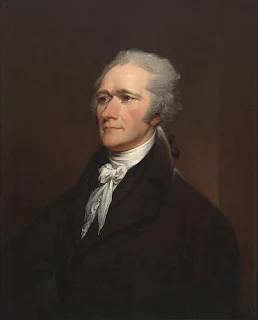

Alexander Hamilton is a prominent figure in American history, renowned for his influential role in shaping the early United States. As one of the Founding Fathers, he played a crucial role in establishing the nation’s political and economic systems. Hamilton was a member of the Federalist Party, championing its policies and ideals. One of his notable and controversial views was his advocacy for increasing national debt. Additionally, large corporations have the opportunity to borrow directly from the public when seeking financial resources. In this article, we delve into the life and contributions of Alexander Hamilton, his party affiliation, his stance on national debt, and the borrowing options for well-known corporations

Who Was Alexander Hamilton and What Party Did He Affiliate With?

Alexander Hamilton was one of the Founding Fathers of the United States. He was born in the West Indies in 1755 (exact year debated) and later migrated to the American colonies. Hamilton actively participated in the Revolutionary War and was appointed as General George Washington’s aide-de-camp. After the war, he became a leading advocate for a strong central government and played a pivotal role in the formation and ratification of the U.S. Constitution.

Hamilton affiliated himself with the Federalist Party, which he co-founded with John Adams and other like-minded individuals. The Federalist Party emerged in the late 1780s and early 1790s, advocating for a strong federal government, a national bank, a balanced economy, and closer ties with Britain. Hamilton’s affiliation with the Federalists shaped his political career and ideology.

Why Did Hamilton Want to Increase National Debt?

Contrary to conventional wisdom, Hamilton believed that an increased national debt could be beneficial for the young United States. As the first Secretary of the Treasury under President Washington, Hamilton was entrusted with managing the country’s finances and ensuring its economic stability.

Hamilton’s vision was to establish the U.S. as a modern industrial power. To achieve this, he proposed assuming the debts incurred by individual states during the Revolutionary War, consolidating them into a national debt. This plan aimed to provide the federal government with enough financial resources to fund ambitious projects, such as infrastructure development, establishing a strong military, and promoting industrialization.

Hamilton believed that a significant national debt, if handled responsibly, would instill confidence in the government’s ability to honor its obligations. He viewed debt as a catalyst for economic growth, attracting investment, and bolstering the nation’s creditworthiness. Hamilton’s fiscal policies and support for a robust national debt were met with opposition from political rivals who feared excessive government influence and a burden on future generations.

When a Large, Well-Known Corporation Wishes to Borrow Directly from the Public, It Can:

In the realm of corporate finance, established and well-known corporations have the option to borrow directly from the public by issuing various financial instruments. These instruments include corporate bonds and stocks, among others.

- Corporate Bonds: A corporation can issue bonds, which are debt securities typically sold to investors. By purchasing these bonds, investors effectively lend money to the corporation for a specified period, with the corporation agreeing to repay the principal amount plus interest at maturity.

- Initial Public Offering (IPO): If a corporation wishes to raise capital and offer ownership to the public, it can conduct an IPO. This process involves issuing shares of stock for purchase by individuals and institutional investors. Through an IPO, the corporation becomes publicly traded, with its shares traded on stock exchanges.

- Secondary Offerings: Even after conducting an IPO, a corporation may opt to raise additional capital by issuing more shares in what is known as a secondary offering. This enables the corporation to tap into the public market once again and raise funds for expansion, acquisitions, or other financial needs.

Securing Economic Growth and Embracing Public Finance: Alexander Hamilton’s Legacy and Modern Corporate Borrowing

Alexander Hamilton, a prominent figure in American history, was a Federalist who played a pivotal role in shaping the early United States. While controversial, Hamilton’s advocacy for increasing national debt aimed to secure the country’s economic stability and foster its development as an industrial power. In the world of corporate finance, well-known corporations have the opportunity to borrow directly from the public, utilizing instruments such as bonds and stock offerings. These avenues provide corporations with the means to raise capital and finance their expansion and growth aspirations.

References:

- Chernow, Ron. Alexander Hamilton. Penguin Books, 2004.

- Ellis, Joseph J. Founding Brothers: The Revolutionary Generation. Vintage Books, 2002.

- McCraw, Thomas K. The Founders and Finance: How Hamilton, Gallatin, and Other Immigrants Forged a New Economy. Belknap Press, 2012.

- Brookhiser, Richard. Alexander Hamilton, American. Free Press, 1999.

- “Alexander Hamilton.” National Archives, www.archives.gov/founding-docs/hamilton.

- “Federalists and Democrats: Political Parties of Hamilton and Jefferson.” U.S. History.org, www.ushistory.org/gov/3a.asp.

- Ferling, John E. Jefferson and Hamilton: The Rivalry That Forged a Nation. Bloomsbury Press, 2013.

- Carreau, Agnes. “Alexander Hamilton Believed in National Debt as a Positive Good.” Smithsonian Magazine, www.smithsonianmag.com/smart-news/alexander-hamilton-believed-national-debt-positive-good-180942811.

- “When a Corporation Wants to Borrow Money.” Securities and Exchange Commission, www.sec.gov/reportspubs/investor-publications/investorpubsborrowinghtm.html.

- Bouchoux, Deborah. Corporate Finance: A Practical Approach. Wolters Kluwer, 2019.

- “Corporate Bonds.” Investopedia, www.investopedia.com/terms/c/corporatebond.asp.

- “Initial Public Offering (IPO).” Investopedia, www.investopedia.com/terms/i/ipo.asp.

- “Secondary Offering.” Investopedia, www.investopedia.com/terms/s/secondaryoffering.asp.